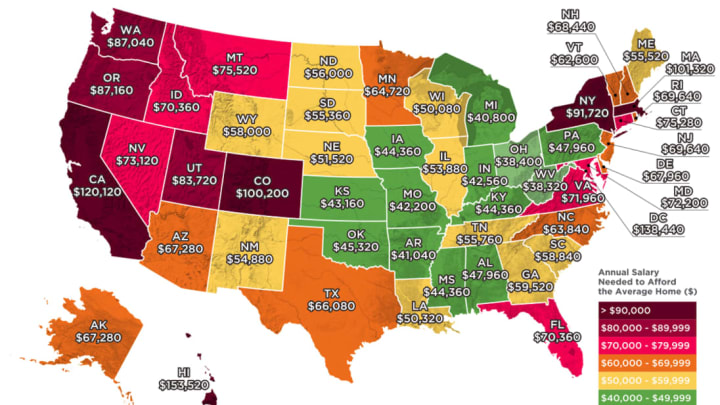

How Much You Need to Make to Afford a Home in Each State

Millennials are increasingly opting to pay rent over mortgages as housing prices creep up across the country. But the American dream of owning a home is more realistic in some places than it is in others. According to this data visualization from the cost information site How Much, where you choose to live can save you tens of thousands of dollars on housing payments a year.

How Much calculated the salary you need to afford the average home in each state by running data from Zillow into a mortgage calculator. They assumed that homeowners would pay interest of 4 to 5 percent depending on the state, make a down payment of 10 percent, and spend 30 percent of their annual income on their mortgage. Based on these numbers, they found West Virginia to be the most affordable state to live in: There you only need to make $38,320 to own the average $149,500 home. Behind it is Ohio with a salary requirement of $38,400 and Michigan with a salary of $40,800. All the states where the minimum salary to own a home falls below $50,000 are located in the South, North-Atlantic, and Midwestern U.S.

At the opposite end of the spectrum, Hawaii occupies the top slot. To afford an average house there, which goes for $610,000, you need to bring home an annual income of at least $153,520. Washington D.C., where you need to make $138,440 or more, is the second most expensive location for homeowners, followed by California with a minimum salary of $120,120.

If the map above doesn't make you feel any more optimistic about owning a home, check out this map from 2017 of the earnings needed to rent a two-bedroom apartment in each state.